All companies that are required to pay value added tax must declare their VAT. However, they must also choose which method they will use: the effective method or the declaration based on flat rates (tax liability rate method). Accounting requirements change depending on the method chosen.

What are the differences?

Net tax debt rate method (flat rate)

Many small businesses opt for this method for their value added tax declarations because it minimizes administrative complexity: on the one hand, they have to submit value added tax rates only every six months – instead of every quarters. On the other hand, the use of the flat tax rate also makes the determination of the withholding tax superfluous.

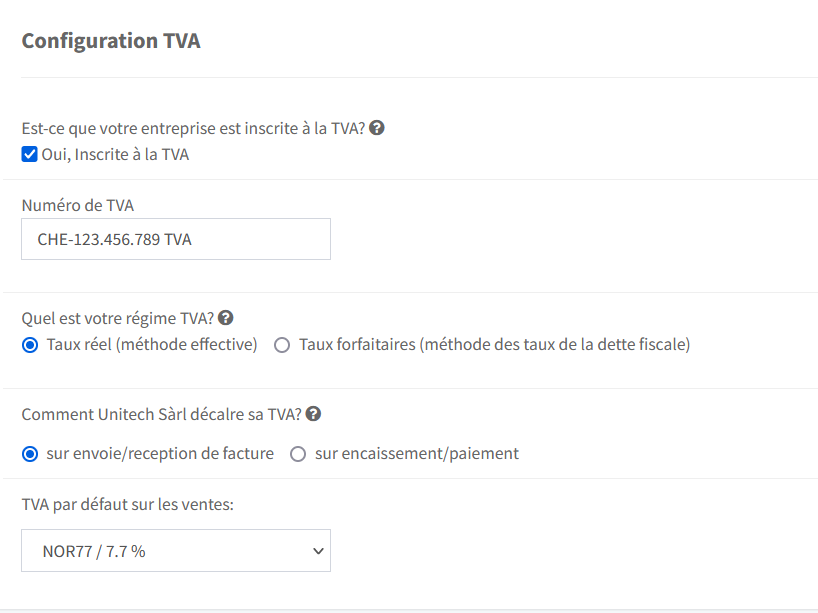

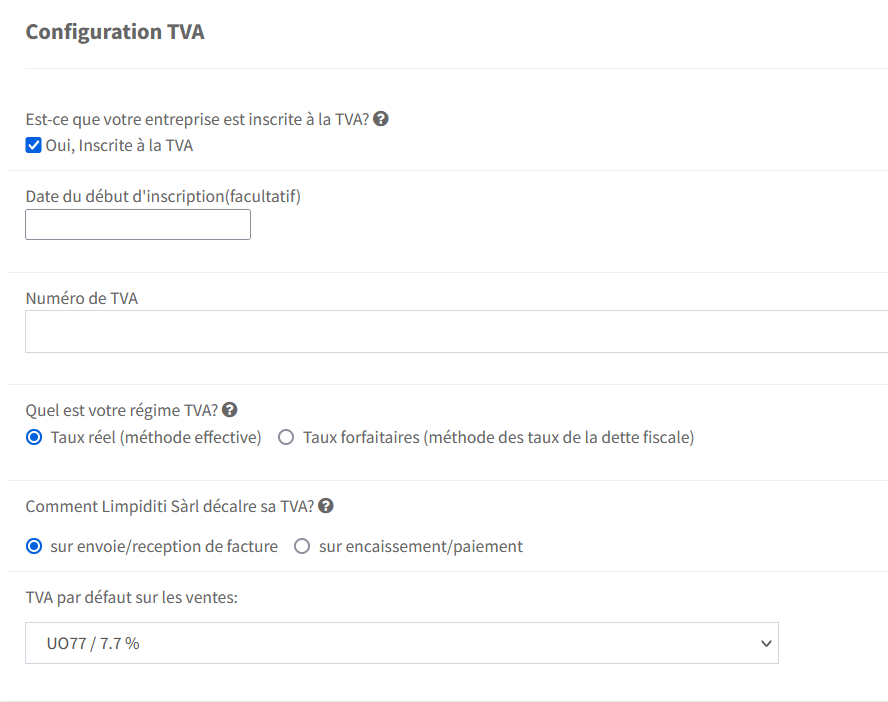

The effective method (actual rate)

The effective declaration of value added tax obliges companies to declare the income generated as well as the accumulated anticipated tax (VAT collected and VAT paid). Companies that choose the effective reporting method must submit their tax returns to the Federal Tax Office (ESTV) on a quarterly basis and they have 60 days to do so after the end of each quarter. The same period applies to payment deadlines.

How to calculate VAT with the net tax debt rate method?

For businesses filing their VAT returns based on flat tax rates, the tax due is determined as follows: Total sales (which includes value added tax charged to customers) is multiplied by the tax rate lump sum taxation (ref. Art. 37 MWSTG). This reduced VAT rate must be approved by the Swiss Tax Administration (ESTV) and depends on the sector of activity of the company. The advantage of this method of VAT declaration is obvious: a fixed amount of tax advance is included and does not have to be declared separately.

The Federal Tax Administration offers this simplified VAT statement for companies whose turnover is less than 5.005 million francs (VAT included) and whose tax liability is a maximum of 103,000 francs per year. These companies can choose to submit VAT on the basis of the flat tax rate, which is lower than the standard rate of 7.7%, if they in return waive the standard procedure for accounting for input VAT, which would otherwise be deducted from VAT levied on turnover (input VAT deduction). This simplified mode of taxation must be maintained for at least one year and VAT returns only have to be filed twice a year (unlike the usual quarterly calculations).