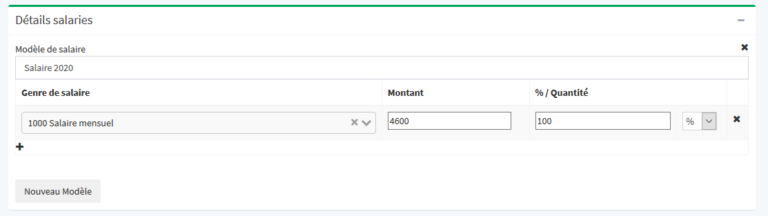

When an employee can use a company vehicle free of charge for their personal needs (private use), the value of this private use (excluding trips between home and work) constitutes a salary element at the rate of 9.6 per cent of the purchase price of the vehicle excluding VAT per year (0.8 per month) or at least CHF 1,800. This element of salary is subject to AVS and VAT.

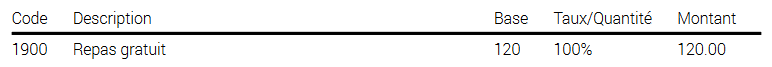

#Example: purchase price of a vehicle excluding VAT: CHF 63,800.00 including 0.8% per month: = CHF 510.40 per month