With this application, you can scan documents and send them to your Fiduly safe via e-mail as attachments.

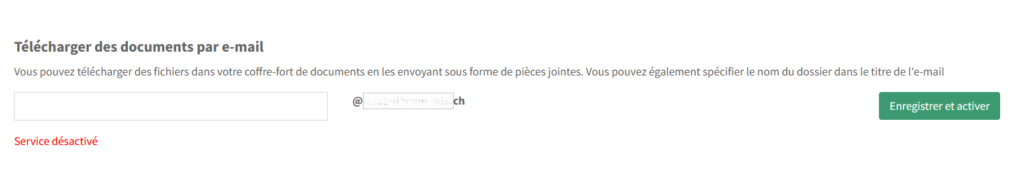

To enable this feature, go to “Settings” / “Team Access”, scroll down to “Upload documents via email”

Choose a name for your download email.

Press “Save and activate”

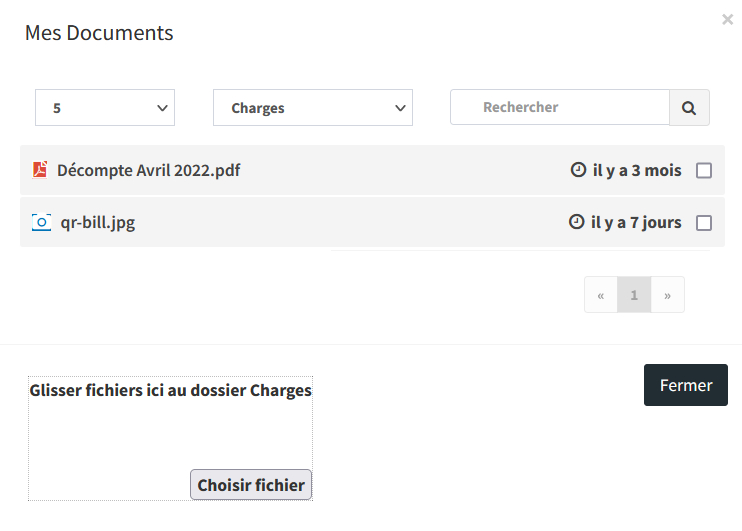

The title of the email allows you to specify the folder in which the file will be saved. If the folder name is not recognized in the title, the file will go to the “uncategorized” folder.

If you mark “expense” in the title of the email, a draft new expense will be created from the content of this file.