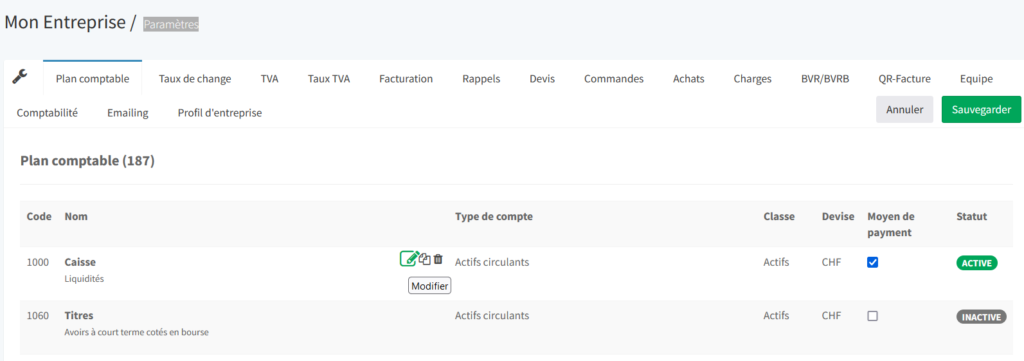

When you create your business in Fiduly, you choose your reference currency (Swiss Francs “CHF” by default). Invoices, expenses, and accounting entries in other currencies must be accompanied by an exchange rate.

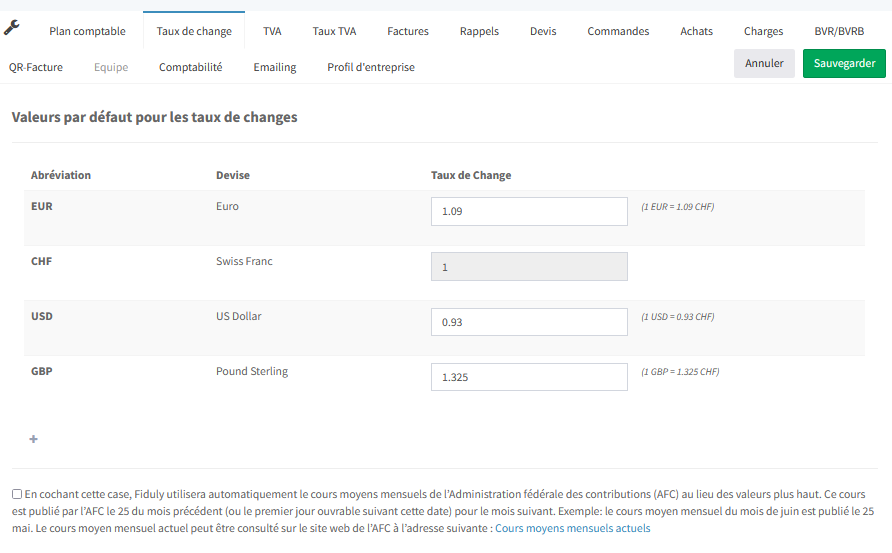

To add a currency, go to “Settings” and choose the “Exchange rates” tab.

Press + and add the currency you want to use and the default exchange rate. This exchange rate will be used by default when you add an invoice, expense or make an entry with this currency. You can subsequently modify this rate at any time.

Fiduly also allows you to automatically use the monthly average prices of the Federal Tax Administration (AFC). This price is published by the AFC on the 25th of the previous month (or the first working day following this date) for the following month. Example: the monthly average rate for the month of March is published on February 25. This option is interesting if you are subject to VAT because it does not entail any advantage or disadvantage compared to the use of daily prices

Depending on the date of the invoice (or expense/accounting entry) Fiduly will use the official average monthly rate of the AFC.

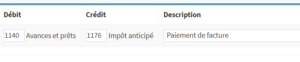

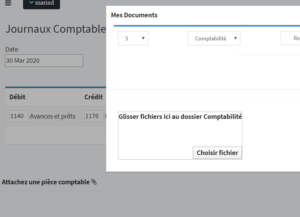

Payment

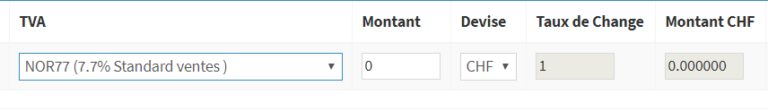

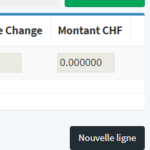

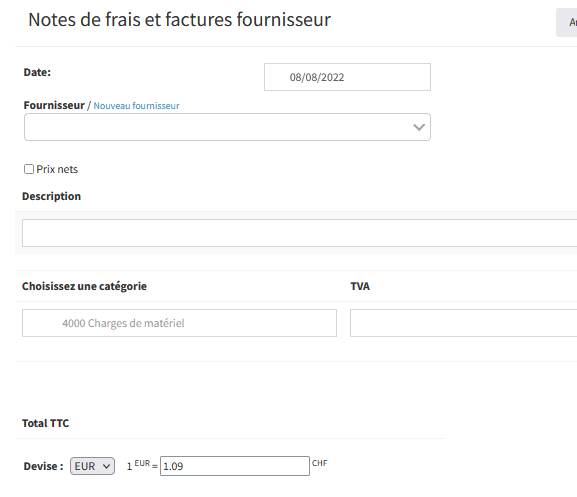

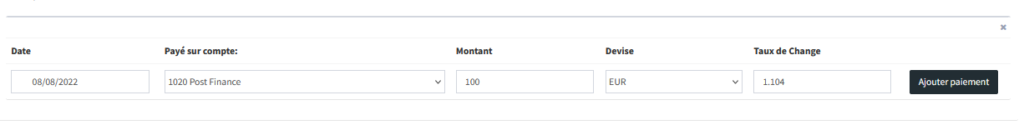

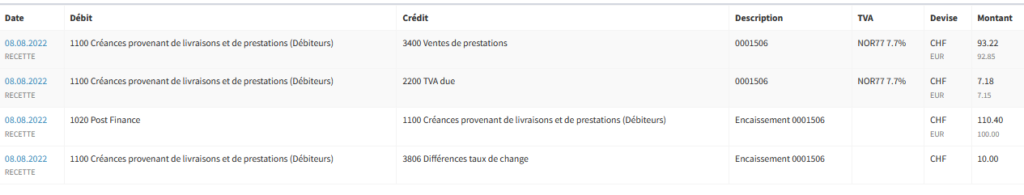

When you collect payment for an invoice, or pay your supplier invoice. You enter the effective exchange rate used by your bank. Fiduly will take care of accounting for the exchange rate difference automatically.

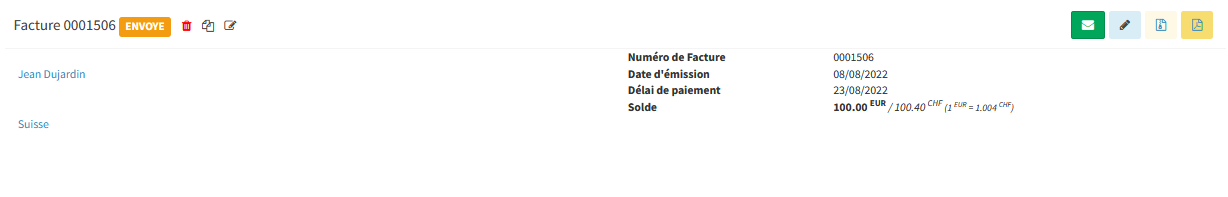

For example, for the following invoice of 100 Euro, the AFC rate used when editing the invoice is 1 Euro = 1.004 Swiss Francs